How to Finance a TMS Machine

The Growing Opportunity in TMS

Transcranial Magnetic Stimulation (TMS) is one of the fastest-growing areas in psychiatry and integrative mental health. With strong FDA support, increasing insurance coverage, and expanding indications like depression, OCD, and smoking cessation, TMS has transformed from a niche therapy into a mainstream treatment.

Yet for many clinicians, the biggest question isn’t whether to offer TMS, but rather how to afford the TMS machine itself!

How Much Does a TMS Machine Cost?

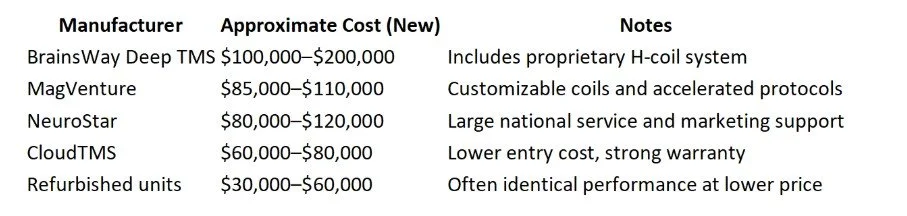

TMS devices vary widely in price depending on brand, features, and service agreements.

Additional expenses may include installation, recurring purchases like patient head caps, service contracts, and marketing — usually $5,000–$15,000 annually.

Common Ways to Finance a TMS Machine

1. Leasing a TMS Device

Leasing allows clinics to start treating patients with minimal upfront cost. Typical terms range from 36–60 months, and many leases include maintenance or coil replacement coverage. However, most machine companies other than a select few don’t actually offer leasing options. As such, you’d have to approach a bank or one of the manufacturers’ preferred lenders. Since the lenders also finance machines, you will likely see that leasing doesn’t come out to be a favorable advantage. Additionally, you lose out on tax advantages like Section 179, which allows you to deduct the full cost of the machine in the year purchased.

2. Best option: Bank and SBA Loans

Traditional lenders can finance medical equipment at lower interest rates (typically 7–12% APR) and longer repayment terms. Documentation and credit requirements are more extensive, but overall cost is often lower than leasing. Additionally, you tend to receive major tax advantages like the ability to use Section 179 deductions. You’ll most likely have to personally guarantee the equipment, but the cost more than makes up for itself once you’ve treated a handful of patients for a few months. It’s highly recommended to speak with your current bank to ask about any medical equipment financing programs they have. If you search hard enough, you may just find a bank with special programs—for example, interest-only payments for the first year before you have to start repaying principle.

3. Manufacturer Financing Programs

Some major TMS companies offer in-house financing, but most simply arrange for partnerships with lenders. As such, it’s usually better to shop your financing offer around.

4. Buying in Cash

Some clinics raise private investment for the purpose of buying machines, or they use cash from their ongoing operations to purchase it without any financing. While you can likely still qualify for the Section 179 tax deduction, it’s usually a less efficient use of capital considering. However, this option avoids drama and personal liability.

When Does a TMS Machine Pay for Itself?

A standard TMS treatment course typically involves 36 sessions, reimbursed at $200–$300 per session depending on payer.

A clinic treating just three patients daily could generate roughly:

3 patients × 36 sessions × $200/session = $21,600 per patient series

Even accounting for staff, rent, and financing costs, most clinics reach break-even within 6–12 months if utilization remains consistent.

Pro tip: Solstice Training Institute’s TMS Business Certification Course includes tips and tricks to maximize your insurance billing in order to help you achieve profitability from day one.

Key Considerations Before Financing

· Train your team — most insurers require providers and technicians to be properly certified.

· Review service contracts for coil replacement, maintenance, and downtime coverage.

· Ensure proper insurance coverage is in place – lenders will want you have property coverage. · Plan for UCC filings as lenders expect to be in first lien position, meaning that they have the right to the asset (or dollar amount that the asset is worth) in the event of bankruptcy.

· Plan for scalability: some clinics add a second chair or coil once utilization exceeds 70%.

How Solstice Training Institute Can Help

Solstice Training Institute, A Public Benefit Corporation (STIPBC) equips clinicians and entrepreneurs with the tools to succeed in every aspect of TMS care—from clinical competency to business sustainability.